Home Owner Lookup By Name

Assessor - Property Search

For additional information, please visit the following website resources Assessor Portal : detailed property and assessment information Property Tax Portal : detailed property tax information and billing Important Updates Hide The Los Angeles County Assessor’s Office is actively monitoring the ongoing fires across the County.

https://assessor.lacounty.gov/homeowners/property-search

How to Find Out Who Owns a Property: 18 Ways in 2026

Finding property owners in 2026 is easier than ever thanks to online databases and public records. The U.S. General Services Administration made real ...

https://www.amerisave.com/learn/how-to-find-out-who-owns-a-property-ways-inSearch for Unclaimed Property

Search for Unclaimed Property Controller Malia M. Cohen safeguards this lost or forgotten property for as long as it takes to reunite it with the rightful owners. Important Notice: Temporary Processing Delays The State Controller’s Office, Unclaimed Property Division, is currently implementing a new processing system designed to enhance service and efficiency.

https://www.sco.ca.gov/search_upd.html

Riverside County Assessor - County Clerk - Recorder - Home ...

Change in Ownership - Death of Property Owner · Property Owners Statement of New ... Strategic Plan 2023-2026 · What We Do · Archives · Book an Appointment · Fee ...

https://www.rivcoacr.org/Home Office of the Treasurer-Tax Collector, Riverside County, California

My staff and I are dedicated to improving your online experience to better help you find pertinent information. This would include online payments and tax status, important dates, upcoming tax sales, news and office hours and locations. On behalf of the County of Riverside, we thank you for your timely payment of property taxes.

https://countytreasurer.org/

Treasurer-Tax Collector

The second installment of your property tax bill is due February 1, 2026. Info on New City of San Diego Trash Fee For questions about the new trash fee on your property tax bill, please contact the City of San Diego directly: Ph.: (858) 694-7000 Email: [email protected] SEARCH, SELECT & PAY IT'S THE BEST WAY 1 SEARCH Search for your bill using parcel/bill number, mailing address or unsecured bill...

https://www.sdttc.com/

Assessor Property Records Search - Owner Search

Author: James Keller Number: SX04...

https://propertysearch.jeffco.us/propertyrecordssearch/ownerProperty Taxes - Lookup - Alameda County's Official Website

Pay or look up unsecured taxes for boats, business personal property, and possessory interest.

https://propertytax.alamedacountyca.gov/

Clark County Assessor's Office Official Site

Assessor Assessor Operating Hours Mon: 7:30am - 5:30pm Tue: 7:30am - 5:30pm Wed: 7:30am - 5:30pm Thur: 7:30am - 5:30pm Fri: Closed Sat: Closed Sun: Closed 2025/2026 Rental Rates Payment Dropbox Update In an effort to ensure the safety of your financial information, effective Immediately, the Assessor’s Office will no longer be accepting payments in the payment drop box located at the Clark County Government Center.

https://www.clarkcountynv.gov/government/assessor/

Hendry County Property Appraiser

We are excited to welcome you to our website. It serves as an extension of our office and we hope you find it to be as informative and helpful as visiting one of our locations. It is our goal to provide the most current information on properties located within Hendry County. If you need assistance, please feel free to contact our office. Dena R. Pittman, CFA...

https://hendryprop.com/

Monroe County Property Appraiser Office

Welcome to the Monroe County Property Appraiser’s website! Think of this site as an extension of our office, designed to give you easy access to the most up-to-date property assessment information in Monroe County. We hope you find the resources here helpful and your visit informative.

https://www.mcpafl.org/

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

Tax considerations when selling a home Internal Revenue Service

IRS Tax Tip 2023-81, June 14, 2023 Many people move during the summer. Taxpayers who are selling their home may qualify to exclude all or part of any gain from the sale from their income when filing their tax return. When selling a home, homeowners should think about: Ownership and use To claim the exclusion, the taxpayer must meet ownership and use tests.

https://www.irs.gov/newsroom/tax-considerations-when-selling-a-home

Property Taxes - Constitutional Tax Collector

The property tax season begins with the mailing of the Notice of Proposed Taxes (Truth-In-Millage or TRIM Notice) each August sent by the Property Appraiser’s Office. Then, by November 1, the Tax Collector’s Office mails more than 600,000 property tax bills to property owners.

https://www.pbctax.gov/taxes/property-tax/

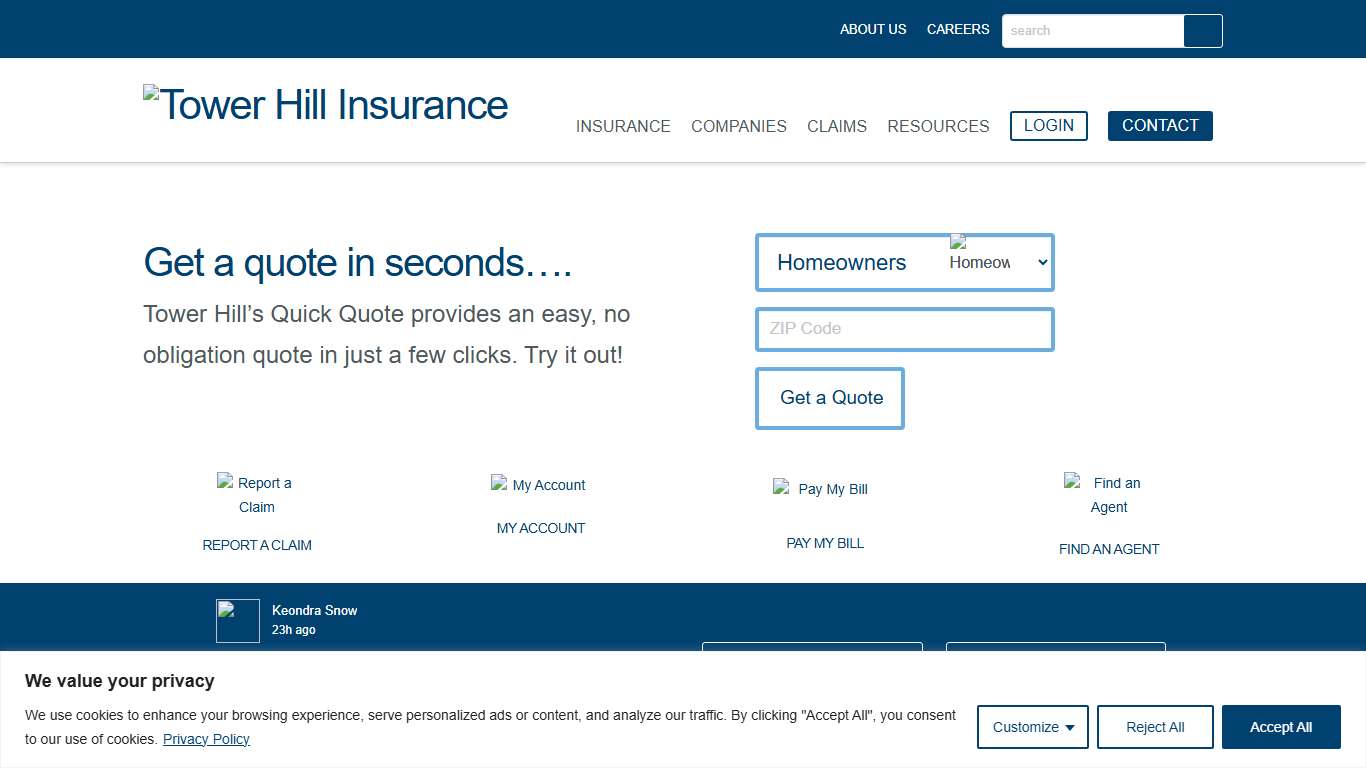

Tower Hill Insurance Florida Homeowners Insurance and More

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies. Privacy Policy Customize Consent Preferences We use cookies to help you navigate efficiently and perform certain functions.

https://www.thig.com/

Property Management Owner Portal Buildium

An owner portal lets you give property owners 24/7 access to critical resources, reducing phone calls and emails. You can share financial reports in real time, collect payments online, share important documents and more—from anywhere. With a property owner portal, owners of rental properties are able to see up-to-date financials and reporting, resolve outstanding tasks and approve invoices, and access important documents—24/7 from any device, ...

https://www.buildium.com/features/property-owner-portal/